- Managing the possible consequences of the corona crisis is currently a top priority, professional project organisation already established

- Good order intake in Q4 2019, although not all expected orders were placed in security printing and metal decorating

- Follow-up orders of strategic importance in digital decor and corrugated printing received after the close of the financial year 2019

- Group revenue in 2019 at the previous year’s level

- EBIT margin of 4.6% below target due to some special items

- Significant cash flow improvement in Q4

- Equity ratio of 34.3%

- Suspension of the dividend payment for 2019 in view of the significantly increased uncertainties caused by the corona crisis

- Impacts of the corona crisis on group performance in 2020 are currently completely open

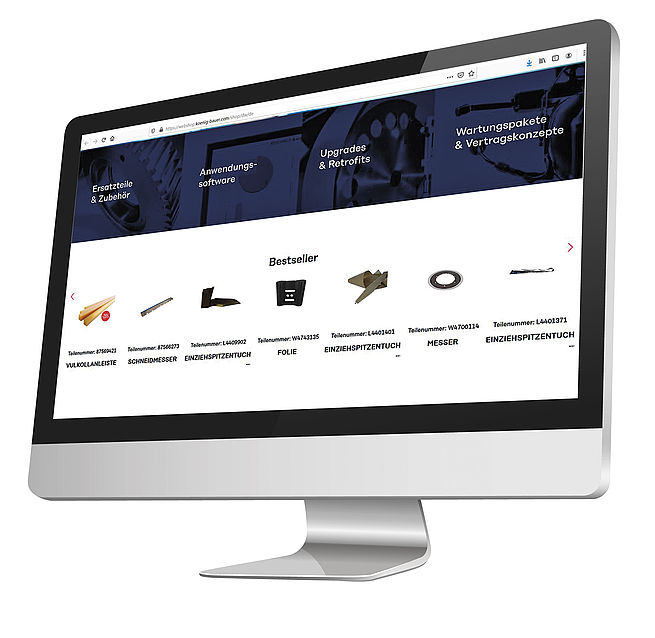

With its strategic focus on the growth market of packaging, Koenig & Bauer is on track to reduce the dependency on politically volatile und lumpy security printing business by increasing revenue and earnings in this area. Through the acquisition of Iberica and Duran, the joint venture with Durst as well as various partnerships in the software field, the portfolio for packaging printing markets was expanded further. Following a testing phase of the CorruCUT sheetfed flexo press for analogue direct printing on corrugated board, the prestigious pilot customer and development partner Klingele accepted the newly developed machine after a demanding factory acceptance test. The machine is now producing in two shifts at the Klingele plant in Delmenhorst near Bremen, Germany. With the CorruFLEX order from Thimm Packaging Systems, Koenig & Bauer received a strategically important follow-up order in corrugated board printing. Interprint ordered the third RotaJET for digital decor printing. After the sixth press sale for digital decor printing and the key order from Tetra Pak for digital full-colour beverage carton printing, the RotaJET digital printing platform is particularly successful in the market. The service initiative launched in 2016 is also bearing fruit. The service revenue share in the Koenig & Bauer group increased significantly from 25.9% in the previous year to 28.2%.

CEO Claus Bolza-Schünemann: “The end markets we address are fundamentally intact with packaging printing showing good structural growth. However, growth requires normal business years. Due to the increasing economic uncertainty, we decided to invest significantly in reducing manufacturing costs and to join forces more strongly within the group. With these measures, we aim to position ourselves to a greater extent independent of the economy and more competitively for the future.”

Dr Andreas Pleßke, the Management Board member responsible for the Performance 2024 programme explains further details: “With the Performance 2024 programme, we are currently targeting reducing costs by over €70m by 2024 with one-off costs of €30m to €40m. We expect the package of measures to be expanded further. The focus of the various projects aimed at optimising group-wide structures and processes is on considerably reducing manufacturing costs to achieve a significant improvement in the earnings situation in the new machine business. This includes design-to-cost projects, purchasing optimisations and some further measures. Bundling tasks as shared services as well as the reduction of holding costs and SG&A expenses are also on the agenda.”

CFO Dr Mathias Dähn adds: “In addition to the cost-cutting projects, the efficiency programme aims to reduce lead times in assembly and accelerate customer acceptance. In addition to shorter delivery times, this will lead to a drop in working capital and a cash flow improvement. Moreover, we work with further activities and a sophisticated controlling of all measures with permanent monitoring on the significant reduction in working capital. We see considerable potential for improvement, particularly in security printing in terms of inventories and receivables through optimised sales management and stepping up export financing. The comprehensive package of measures also aims at a more even distribution of revenue over the year in the Sheetfed segment.”

Business performance in 2019 in the Koenig & Bauer group

Not all expected orders in security printing and metal decorating were awarded in 2019, therefore order intake and order backlog of €1,141.3m and €533.7m respectively were below the figures for the prior year (€1,222m and €610.9m respectively) favoured by the major Egyptian order. With €1,218.5m, group revenue reached the level of the prior year (2018: €1,226m). Earning were burdened by high investments in the growth offensive 2023. While a lack of profit contributions due to delayed or shifted contract closings and higher costs in order processing further reduced earnings, one-time income had a positive effect. On balance, a margin of 4.6% was achieved with EBIT of €56m (2018: €87.4m and 7.1% respectively). At €38.4m, group net profit (previous year: €64m) translates into earnings per share of €2.31 in 2019 (2018: €3.86). In view of the significantly increased uncertainties caused by the corona crisis, the Management Board and Supervisory Board will propose to the annual general meeting to suspend the dividend payment for the financial year 2019 and to carry forward the retained profit generated by the holding company Koenig & Bauer AG to new account. The fundamental policy of distributing 15% to 35% of group net profit remains unaffected.

Business performance in 2019 in the segments

In addition to the strong service business, more orders for large- and medium-format presses led to growth in order intake in the Sheetfed segment of 8.9% to €625.3m (2018: €574.3m). Compared to 2018 (€615.9m), revenue increased by 2.6% to €631.8m. The slightly lower order backlog of €183.4m compared to the previous year (€189.9m) remained at a good level. Due to the product and regional mix and higher order processing costs, EBIT of €19.4m was below the figure from the prior year (€35.4m).

In Digital & Web, order intake of €144.9m was 18% below the prior-year’s figure of €176.6m. In addition to the shrinking web offset service business, lower orders in flexible packaging printing were the main reason for this decline. Revenue increased by 7.4% from €153.3m to €164.6m. On balance, the order backlog decreased from €85.8m to €66.1m at the end of 2019. The EBIT of –€16.5m (previous year: –€10.2m) was burdened by high market-entry and growth-related expenses as well as the negative result in flexible packaging printing.

In the Special segment, order intake of €406.7m was below the prior-year’s figure of €505.1m, which was impacted by a major order in security printing. After €491.5m in the previous year, revenue of €463.9m was achieved. Order backlog at the end of 2019 was €287.3m (31 December 2018: €344.5m). As a result of the lower revenue, product mix and unexpected project expenses for the major security printing order, EBIT amounted to €43.9m after €48.2m in the previous year despite one-time income.

Above-average balance sheet ratios

In addition to the high investment expenditures and the dividend payment, cash flows were influenced by one-time effects such as the significant capital lock-up resulted from the major Egyptian order. Accordingly, cash flows from operating activities of –€7.9m and free cash flow of –€52.3m were below the prior-year figures (€66.3m and –€19.5m respectively). The long-term credit facility syndicated by renowned banks is strengthening the group’s stability. In terms of balance sheet ratios, the Koenig & Bauer group is well-positioned with an equity ratio of 34.3%.

Guidance for 2020

CFO Mathias Dähn: “Even before the outbreak of the coronavirus, global economic conditions were demanding. Given the daily worsening global economic situation due to the coronavirus, the impacts on our company and the achievement of our planning are currently completely open. For 2020, we are planning to achieve a largely stable group revenue compared to the previous year and the prior year's EBIT level without the around €10m in special expenses from the efficiency programme. Managing the possible consequences of the corona crisis is currently a top priority.”

The Annual Report can be downloaded as a PDF file from here.